Who’s Earning Future Value? Who’s Running Out of Time?

Last week, we established that you can be building new things and still lose the market. What matters is whether the outside world sees enough credible momentum to price in future returns.

Innovation premium isn’t a vanity metric, it’s a market signal. It reflects how much investors believe your company has a future, not just a present.

And that belief is priced into your Innovation Premium. (Or not.)

This week, we’re sharing a model that estimates how much of a company's value comes from belief in future innovation. And to show you how it comes to life, we’ve run an analysis across much of the S&P 500.

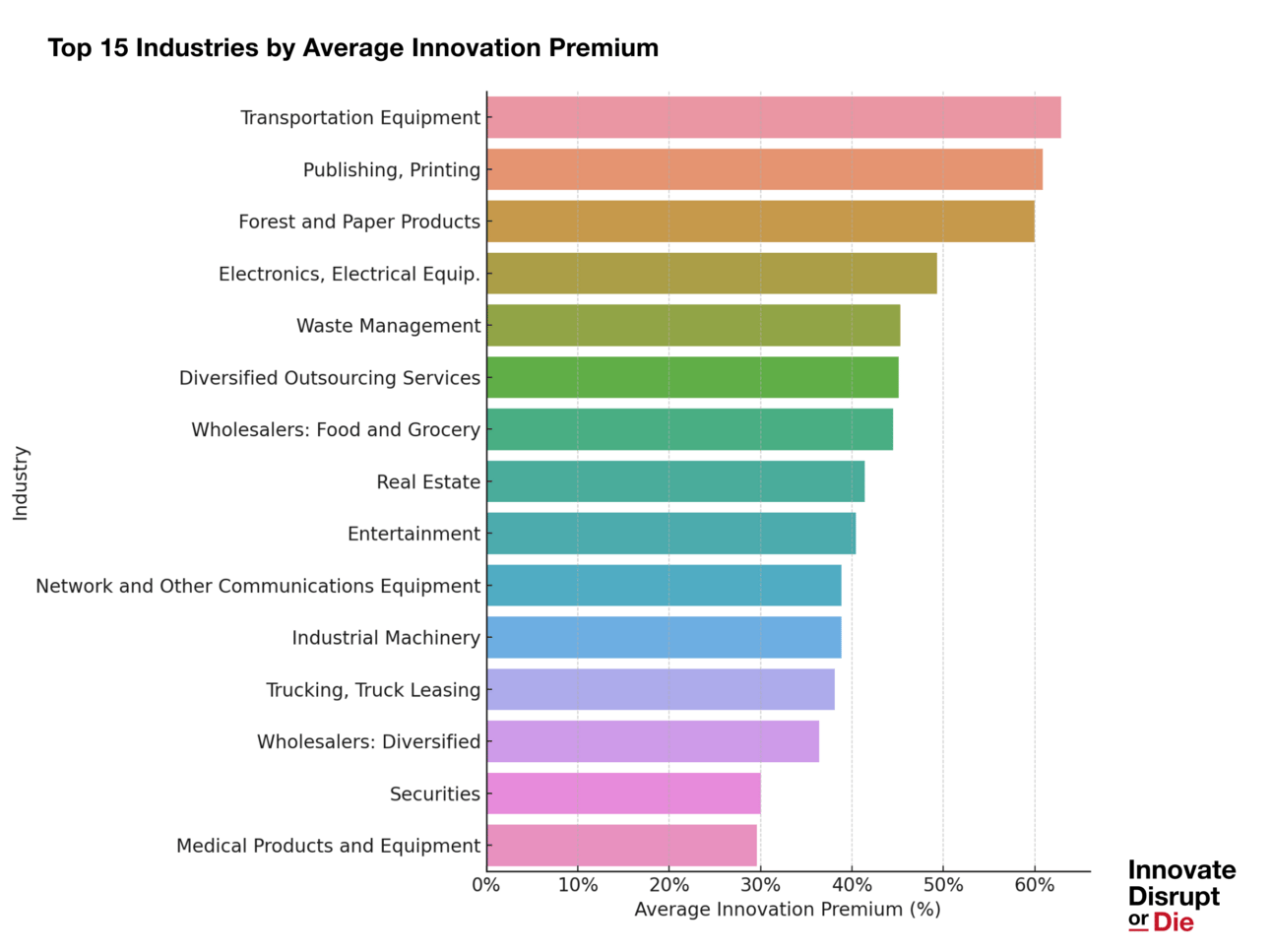

Using consistent assumptions across 397 public companies, we built the Innovation Premium Index, a model estimating how much of each of these public company’s valuation is driven by market expectations of future growth.

We based the index on custom P/E ratios tailored by industry. Instead of relying on the market’s implied P/E, which bakes in unpredictable investor sentiment, we assigned a consistent valuation multiple to each company based on the norms of its sector. Retail and industrial firms were typically modeled at 12.5x or 17.5x earnings. Tech, fintech, and healthcare companies used higher benchmarks like 20x, 27.5x, or even 35x where appropriate.

This approach removes sector bias while keeping the analysis grounded in business reality. The goal wasn’t to smooth the numbers, but rather to reflect how each sector is normally valued so we could clearly see where belief in future growth is inflating value above those fundamentals.

By applying a consistent but tailored benchmark ratio across companies, we strip out the noise and isolate the signal: how much of a company's valuation is based on belief in future innovation, not just earnings today. It also gives us apples-to-apples comparisons across the index.

This is how we make future value visible. And measurable.

Here’s what we found.

Insight 1: The Top Performers Aren’t Just Riding Momentum

These companies have convinced the market that they’re building new growth engines. And that those engines are already in motion.

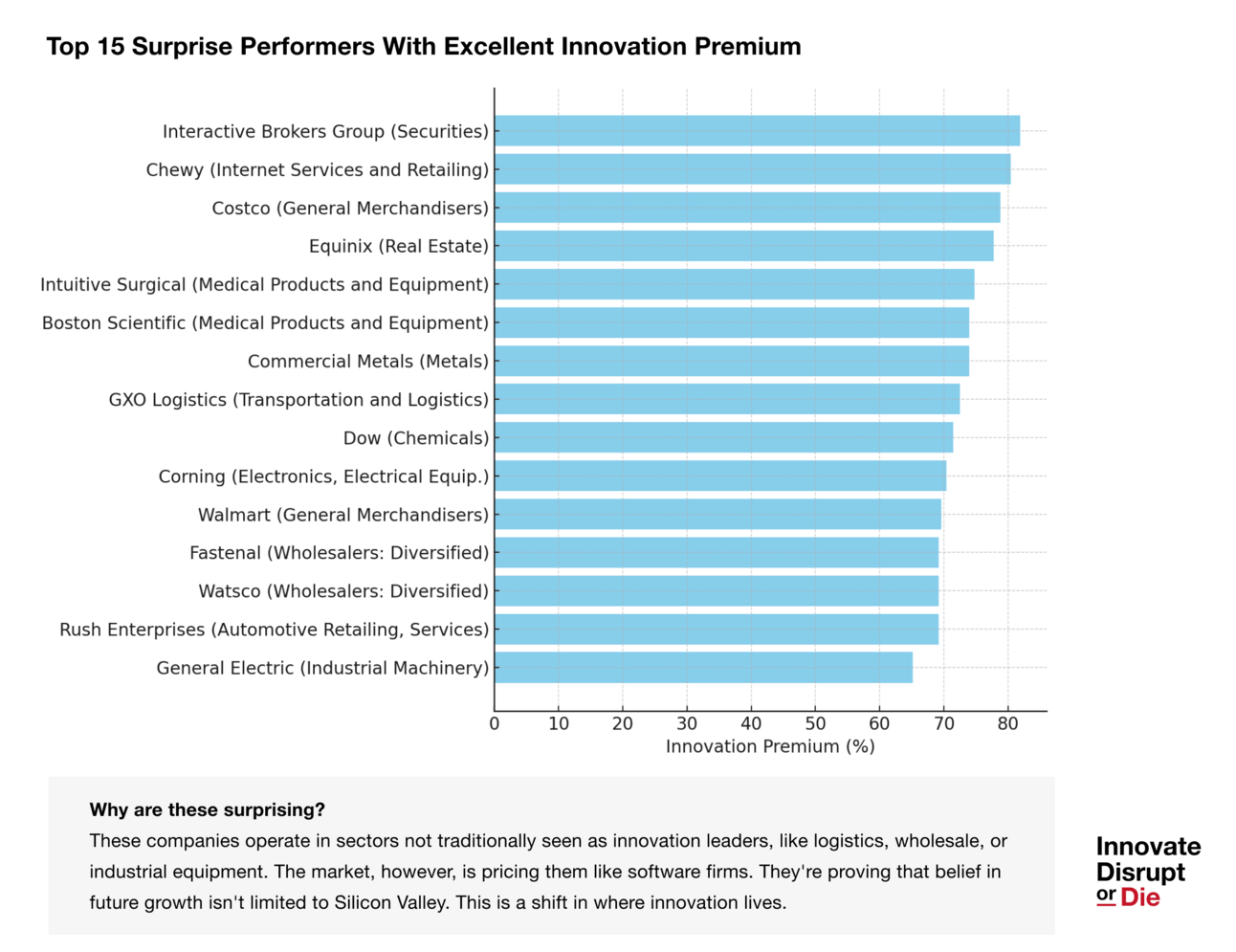

Top 5 by innovation premium (as % of market cap):

Interactive Brokers – 81.9%

Chewy – 80.4%

Costco – 78.8%

Equinix – 77.7%

Intuitive Surgical – 74.8%

This isn’t just a valuation quirk. It’s a bet. A bet that these companies have credible, scalable, high-margin growth coming that hasn’t hit earnings yet.

This is the free prize inside.

When innovation leaders succeed in telling the right story about their future, and then backing that story up with tangible outcomes, their company’s reap the rewards in the form of increased value above and beyond what today’s operations would indicate.

Insight 2: It's Not Just a Tech Story Anymore

The biggest surprise? Software firms aren’t leading this list. (At least not right now.) The top performers come from finance, retail, real estate, and healthcare. That doesn’t mean tech is out of favor. It means other sectors have done a better job of making their future visible and investable.

Belief spans sectors.

Costco, a retailer; Equinix, a real estate infrastructure play; and Intuitive Surgical, a medical device leader, are all in the top 10. Proof that the market rewards clarity of future value, not just category buzz.

Infrastructure and logistics.

Companies like Equinix, GXO Logistics, and Commercial Metals are pulling belief premiums thanks to platform economics and expansion capacity.

Consumer brands.

Orgs like Chewy are rewarded for data-driven loyalty, DTC dominance, and adjacencies that haven’t hit the P&L yet.

The companies showing low or negative premiums?

Mostly traditional energy, utilities, and financials.

Not because innovation is impossible there. The market simply isn’t buying the narrative yet.

As we outlined last week, innovation premium is driven as much by story as by numbers. The market doesn’t wait for results. It moves on belief. And belief is built through narrative: a credible, visible, and emotionally resonant signal that the company’s future is already under construction.

If that signal is missing, even good work can go unrecognized.

Insight 3: If You Don’t Show Your Future, You May Not Have One

Your innovation strategy isn’t just about optionality. It’s about visibility. If your bets, pilots, and pipelines aren’t visible to the market, they don’t count.

Innovation premium doesn’t show up because you “support innovation.”

It shows up because the street sees traction.

It shows up because someone is owning the narrative, surfacing the signals, and proving that new revenue is more than a hopeful slide.

If you’re building something real and no one sees it, it’s the same as building nothing.

How Innovation Leaders Can Use This Data

This index isn’t just for reflection. It’s a tool. If you’re responsible for innovation, this is how you turn raw valuation data into leverage, both inside your org and out in the market.

Benchmark Your Company

Start by identifying your company's innovation premium using our model. Compare that number with sector peers to assess whether your market narrative is landing. If your number lags behind similar players, you’re either not showing enough momentum, or the market doesn’t see a credible path to value. Either way, you now know where to dig.

Map the Visibility Gap

Conduct an internal audit: what does the outside world know about your innovation efforts? Are pilots, early traction, and external partnerships being surfaced in a way that builds confidence? Create a timeline of key milestones and make that journey public, even in early forms.

Translate the Work

Package your initiatives in language your CFO — and Wall Street — understands. Don’t talk about optionality. Talk about revenue timelines. Don’t lead with R&D spend. Lead with return potential. Your job is to frame the future in terms the balance sheet respects — and to do it proactively, not defensively.

This isn’t the end of the analysis. It’s the start.

We’re looking at building out sector-specific dashboards, tracking shifts in premium over time, and surfacing case studies of companies punching above their weight.

(Give a shout if you think these analyses would be useful!)

The White Paper

Click here to download our white paper.

Download